The bird view Perspective.

Effective Asset allocation strategies |Create - Measure - Optimise

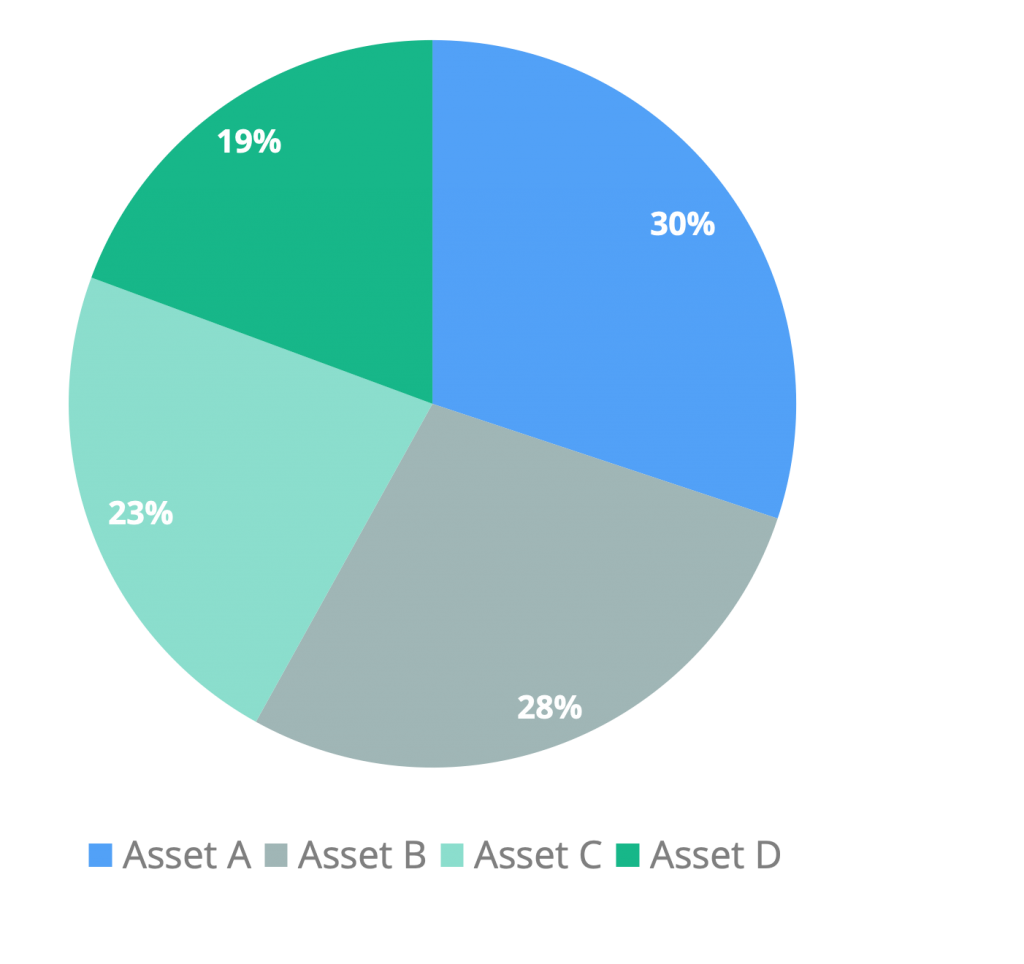

We design, build and deploy macroeconomic, fundamental and statistical factors models, deep learning and stochastic models in constructing, and optimising diversified portfolios and robo-advisory models; taking into account: capital allocation constraints, risk budget, liability profile of pension plans, business cycles and yield curve changes. Effective asset allocation strategies are those that take enough risk to give your portfolio the potential to grow, but not so much that you feel uncomfortable.

- Portfolio construction, performance measurement and optimisation

- Market risk and ESG factors modeling, management and monitoring

- Quantitative short and long term balancing strategies modeling